Discover comprehensive insights into the statistics, market trends, and growth potential surrounding the solar panel manufacturing industry in Colombia

- Sunshine & Daylight Hours in Bogotá, Colombia Sunlight, Cloud & Day length. (2023). Retrieved from https://www.climate.top/colombia/bogota/sunlight/

- Colombia Energy policy Review 2023 – Analysis – IEA. (2023, September 1). IEA. https://www.iea.org/reports/colombia-2023

- Solargis. (n.d.). Global Solar Atlas. The World Bank Group. Retrieved from https://globalsolaratlas.info/map?c=-6.686431,-17.973633,6&r=COL

- World Population Review (2024). Cost of electricity by country 2024. Retrieved from https://worldpopulationreview.com/country-rankings/cost-of-electricity-by-country

- Statista. (2024, June 28). Electricity household penetration in Colombia 2019-2022, by area. Retrieved from https://www.statista.com/statistics/813689/share-households-electricity-access-area-colombia/

- Mordor Intelligence (2023). Colombia Solar Energy Market Size & Share Analysis – Growth Trends & Forecasts (2024 – 2029) Retrieved from https://www.mordorintelligence.com/industry-reports/colombia-solar-energy-market

- López, A. R., Krumm, A., Schattenhofer, L., Burandt, T., Montoya, F. C., Oberländer, N., & Oei, P. Y. (2020). Solar PV generation in Colombia-A qualitative and quantitative approach to analyze the potential of solar energy market. Renewable Energy, 148, 1266-1279. http://large.stanford.edu/courses/2023/ph240/sandoval2/

- IRENA and USAID Report: Renewable Energy Auctions in Colombia. Retrieved from https://www.irena.org/-/media/Files/IRENA/Agency/Publication/2021/March/IRENA_auctions_in_Colombia_2021.pdf

- Enerdata.(Aug, 2023): Colombia Energy Report. Retrieved from https://www.enerdata.net/estore/country-profiles/colombia.html

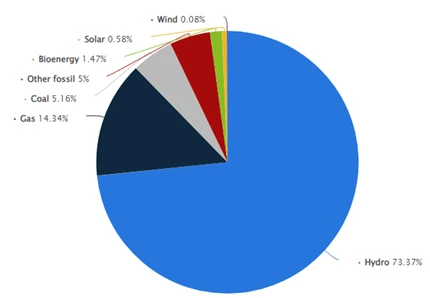

- Statista. (2024b, June 28). Electricity production breakdown in Colombia 2022, by source. https://www.statista.com/statistics/617820/share-of-electricity-production-in-colombia-by-source/

- World Bank Group (2023). Access to electricity (% of population) – Colombia. Retrieved from https://data.worldbank.org/indicator/EG.ELC.ACCS.ZS?end=2022&locations=CO&skipRedirection=true&start=2016&view=chart

- PV Magazine (2024). Colombia’s large-scale PV capacity additions hit 207 MW in 2023

Retrieved from https://www.pv-magazine.com/2024/03/14/colombias-large-scale-pv-capacity-additions-hit-207-mw-in-2023/ - IDB (2021). Status of the off-grid renewable energy market in Latin America & the Caribbean. Retrieved from https://www.ruralelec.org/wp-content/uploads/2023/11/Status-of-the-off-grid-renewable-energy-market-in-Latin-America-the-Caribbean-2021.pdf

- G. (2020, March 11). SAIS Perspectives is a publication out of Johns Hopkins School of Advanced International Studies focusing on issues of development, climate, and sustainability. SAIS Perspectives. Retrieved from http://www.saisperspectives.com/2020-issue/2020/3/9/off-grid-clean-energy-in-colombia

- López, A. R., Krumm, A., Schattenhofer, L., Burandt, T., Montoya, F. C., Oberländer, N., & Oei, P. Y. (2020). Solar PV generation in Colombia-A qualitative and quantitative approach to analyze the potential of solar energy market. Renewable Energy, 148, 1266-1279. http://large.stanford.edu/courses/2023/ph240/sandoval2/

- Salary Explorer: Electrician average salary in Colombia. Retrieved from https://www.salaryexplorer.com/average-salary-wage-comparison-colombia-electrician-c47j245

- Economic Research Institute: Solar Panels Sales Representative Average Salary in Colombia. Retrieved from https://www.erieri.com/salary/job/solar-panel-sales-representative/colombia

- Glassdoor: Sales Manager Salaries in Colombia. Retrieved from https://www.glassdoor.com/Salaries/colombia-sales-manager-salary-SRCH_IL.0,8_IN54_KO9,22.htm

- Economic Research Institute: Electrical Design Engineer Salary. Retrieved from https://www.erieri.com/salary/job/electrical-design-engineer/colombia

- Worldometer: Colombia Population. Retrieved from https://www.worldometers.info/world-population/colombia-population/

- WageIndicator: Minimum Wage- Colombia. Retrieved from https://wageindicator.org/salary/minimum-wage/colombia

- Climatescope by Bloomberg NEF-Colombia. Retrieved from https://www.global-climatescope.org/markets/co/

- Water supply and sanitation in Colombia. Retrieved from https://en.wikipedia.org/wiki/Water_supply_and_sanitation_in_Colombia#:~:text=Water%20consumption%20is%20metered.,who%20consume%20more%20than%2028m3.

- Global Energy-An Overview of Colombia. Retrieved from https://www.geni.org/globalenergy/library/national_energy_grid/colombia/EnergyOverviewofColombia.shtml

- Climate Transparency : National policies that promote the phase in of renewables. Retrieved from https://www.climate-transparency.org/wp-content/uploads/2023/11/Implementation-Check-Colombia-Coal-phase-out-2023.pdf

- SER Colombia Retrieved from https://ser-colombia.org/

- Renewable Energy Auctions in Colombia. Retrieved from https://www.irena.org/-/media/Files/IRENA/Agency/Publication/2021/March/IRENA_auctions_in_Colombia_2021.pdf

- EI Paso Solar Park. Retrieved from https://www.enelgreenpower.com/media/news/2019/04/el-paso-photovoltaic-plant-colombia-brought-online

- Celsia Bolivar Solar PV Park. Retrieved from https://www.power-technology.com/data-insights/power-plant-profile-celsia-bolivar-solar-pv-park-1-colombia/

- Seirpe Solar PV Park. Retrieved from https://www.power-technology.com/data-insights/power-plant-profile-la-sierpe-solar-pv-park-colombia/

- Yumbo Solar Farm. Retrieved from https://www.gem.wiki/Yumbo_solar_farm

- La Loma Solar Farm. Retrieved from https://www.enelgreenpower.com/our-projects/operating/la-loma-solar-project

- Atlantico Sabanalarga. Solar PV Park. Retrieved from https://www.power-technology.com/marketdata/atlantico-sabanalarga-solar-pv-park-colombia/

- EI Espinal Cubico Solar PV Park. Retrieved from https://www.power-technology.com/data-insights/power-plant-profile-el-espinal-cubico-solar-pv-park-colombia/

- 13 top Renewable Energy companies and startups in Colombia in November 2024 (n.d.). https://www.f6s.com/companies/renewable-energy/colombia/co

- Mordor Intelligence: Colombia Solar Energy Company List https://www.mordorintelligence.com/industry-reports/colombia-solar-energy-market/companies

- Statista (2023). Average rent of industrial and logistics real estate in Colombia from 2022 to 2023, by city (in 1,000 Colombian pesos per square meter). Retrieved from https://www.statista.com/statistics/1421010/colombia-industries-average-rent/

- Climate Investment Fund (2023). CIF approves $70 million to accelerate Colombia’s integration of clean energy into the power grid. (n.d.). https://www.cif.org/news/cif-approves-70-million-accelerate-colombias-integration-clean-energy-power-grid

- Celsia Solar https://www.celsia.com/en/